Lithium prices were flat for the past month. Morgan Stanley says 2021 should see lithium's market closer to balance as supply cuts bite and demand recovers, prices capped for now.

Lithium market news - US declares a national emergency to deal with the threat of US critical materials supply. Biden campaign tells miners it supports domestic production of EV metals.

Lithium company news - Tianqi Lithium warns of $1.9 billion default as loan date looms. Pilbara Minerals achieved higher recoveries, stronger production and sales.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to the October 2020 edition of the lithium miner news. October saw lithium prices flat and numerous calls from within the US to support the EV metal miners (White House Executive order on critical minerals, Biden to support EV metals). There was also the usual very strong lithium demand forecasts such as "lithium demand seen doubling in next four years". Tesla (TSLA) Battery Day also served as a major acceleration to the EV boom and hence a wake-up call for auto manufacturers to secure EV metals or risk missing out. You can read more on this in my recent Trend Investing article: "Tesla Just Put The Accelerator Down On The EV And Battery Boom."

During October, 99.5% lithium carbonate China spot prices were up 0.92%. Lithium hydroxide prices were down 0.34. Spodumene (6% min) prices were unchanged.

Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan & Korea of US$6.75/kg (US$6,750/t), and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan & Korea of US$9.00/kg (US$9,000/t).

Benchmark Mineral Intelligence has September global weighted average prices at US$6,086/t for Li carbonate, US$8,795/t for Li hydroxide, and US$375/t for spodumene (6%).

Lithium carbonate & hydroxide, battery grade, cif China, Japan & Korea

Source: Fastmarkets

As part of a September 28 article on the Piedmont Lithium/Tesla deal the Investors.com article quoted:

Morgan Stanley note - "Separately in a note Monday, Morgan Stanley analysts gave a strong lithium outlook. They wrote that "2021 should see lithium's market closer to balance as supply cuts bite and demand recovers, but the large volume of latent hardrock capacity and continued brine expansions cap price upside."

BNEF updated Li-ion battery demand outlook (June 2020)

Note: This may soon be updated considerably higher in the years 2025 to 2030 following Tesla Battery Day.

Source: Bloomberg New Energy Finance [BNEF]

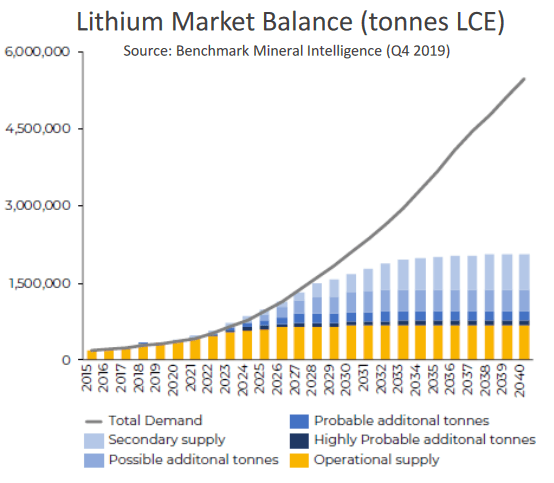

Benchmark Mineral Intelligence lithium demand v supply forecast

Source: Core Lithium courtesy of Benchmark Mineral Intelligence

2019 to 2030 'battery' demand increase forecast for EV metals as the EV boom takes off

Source: Courtesy BloombergNEF

Benchmark Mineral Intelligence - Simon Moores's - forecasts

Source: Benchmark Mineral Intelligence Twitter

Some news I missed from last month. Nasdaq reported:

Indonesia says LG Chem, CATL sign deal for lithium battery plant.... Indonesia has set a 2024 target to start producing lithium batteries....Indonesia's Investment Coordinating Board said in June that LG Chem was considering a $9.8 billion investment in an electric vehicle battery factory integrated with a smelter. Meanwhile, CATL is already investing in a plant on Indonesia's Sulawesi island to extract battery-grade nickel chemicals. Indonesia stopped exports of unprocessed nickel earlier this year to ensure raw material supply for nickel investments in the country.

On September 28 Benchmark Mineral Intelligence reported:

Tesla to build lithium hydroxide refinery in Texas to feed Terafactory; first automaker to enter lithium. The EV maker will build a spodumene conversion facility adjacent to the Terafactory / Gigafactory 5 in Austin, Texas in what has a typically aggressive start up target of Q4 2022. This adds to Tesla’s plans to build a cathode facility in Texas in what Elon Musk describes as “part of our cell production plan”. Despite a flurry of Tesla Battery Day announcements, confusion reigned over Tesla’s lithium direction in particular the EV makers plans’ to extract lithium from Nevada-clay, which Benchmark understands is more of an early stage idea than a supply solution.

On September 28 Seeking Alpha reported:

Tesla said to be eying investment in LG Chem. Tesla (TSLA) is looking into purchasing a stake in battery maker LG Chem (OTCPK:LGCLF) of as much as 10%, according to the Korea Times. The report follows word earlier this month that LG will spin off its battery business to create a new company called LG Energy Solutions. Tesla is hoping to secure a supply of batteries as it also goes down a dual path of developing its own batteries.

On September 29 Reuters reported:

Battery maker Northvolt raises $600 million in private placement...with Volkswagen, Baillie Gifford, Goldman Sachs and Spotify founder Daniel Ek among the investors, it said on Tuesday. Northvolt, which aims to take on major Asian players such as CATL and LG Chem and targets a 25% market share in Europe by 2030, said the deal would enable further investments in capacity expansion, research and development, and recycling.

On September 30 The White House announced:

Executive Order on addressing the threat to the domestic supply chain from reliance on (35) critical minerals from foreign adversaries | The White House......I therefore determine that our Nation’s undue reliance on critical minerals, in processed or unprocessed form, from foreign adversaries constitutes an unusual and extraordinary threat, which has its source in substantial part outside the United States, to the national security, foreign policy, and economy of the United States. I hereby declare a national emergency to deal with that threat. In addition, I find that the United States must broadly enhance its mining and processing capacity, including for minerals not identified as critical minerals and not included within the national emergency declared in this order.

Note: The above report says the US Gov. will look into giving "grants to procure or install production equipment for the production and processing of critical minerals in the United States", "loan guarantees" and for projects that support domestic supply chains "funding awards and loans pursuant to the Advanced Technology Vehicles Manufacturing incentive program."

You can view the US critical minerals list here. It contains cobalt, graphite, lithium, manganese, PGMs for catalytic agents (Eg: palladium), rare earth elements group, scandium, titanium, vanadium etc.

On October 6 Reuters reported:

EV battery maker Romeo Systems to go public through a $1.33 bln SPAC deal....Romeo Systems Inc, a battery maker for electric vehicles, will go public through a merger with blank check company RMG Acquisition Corp in a $1.33 billion deal, the companies said on Monday. Romeo will use the proceeds for capacity expansion and research & development to further develop battery system technologies for commercial vehicles, according to a statement. After the deal closes, which is expected in the fourth quarter of 2020, the combined company will list on the New York Stock Exchange under the symbol “RMO”.

On October 6 Reuters reported:

Toyota-Panasonic venture to build lithium-ion batteries for hybrids in Japan.... to manufacture lithium-ion power units for hybrid vehicles beginning in 2022....The production line at a Panasonic factory in Tokushima prefecture will have enough capacity to build batteries for around 500,000 vehicles a year.

On October 6 New Atlas reported:

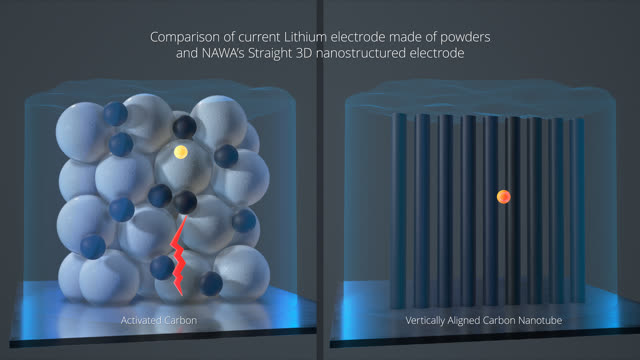

"World's fastest electrodes" triple the density of lithium batteries. French company Nawa technologies says it's already in production on a new electrode design that can radically boost the performance of existing and future battery chemistries, delivering up to 3x the energy density, 10x the power, vastly faster charging and battery lifespans up to five times as long...... Nawa's vertically aligned carbon nanotubes, on the other hand, create an anode or cathode structure more like a hairbrush, with a hundred billion straight, highly conductive nanotubes poking up out of every square centimeter......The result is a drastic reduction in the mean free path of the ions – the distance the charge needs to travel to get in or out of the battery – since every blob of lithium is more or less directly attached to a nanotube, which acts as a straight-line highway and part of the current collector....... We put the question of cost to Nawa. "The million dollar question!" said Boulanger. "Here's a million dollar answer: the process we're using is the same process that's used for coating glasses with anti-reflective coatings, and for photovoltaics. It's already very cheap."

On October 7 Mining weekly reported:

Lithium demand seen doubling in next four years.....On its Battery Day, US EV manufacturer Tesla announced it is working towards achieving 100 GWh of cell production capacity by 2022 and up to 3 000 GWh by 2030. This is far greater than other manufacturers such as China’s BYD, which is expected to expand its capacity to 126 GWh in 2024, versus 40 GWh in 2019. Japan’s Panasonic, a key supplier to Tesla itself, is expected to increase its capacity from 40 GWh in 2019 to 63 GWh in 2021, while LG Chem will expand from 65.2 GWh in 2019 to 172.4 GWh in 2024....

On October 8 Battery Materials Review reported:

October's lead article is about the chronic under-investment in battery raw materials supply and the threat it poses to the EV event. Since 2018 US$50bn has been raised for new battery capacity, US$60bn for EV capacity but only US$8bn in new raw materials capacity…and raw materials capacity takes 2-3 years longer to build. There is now a material risk of supranormal raw material prices which will impact battery prices and EV makers’ profitability.

On October 13 PV-magazine reported:

Lithium-ion gigafactory breaks ground in Australia. Less than a year from now, Australia will start producing its own renewables-storing lithium-ion batteries in New South Wales.

On October 21 Mining.com reported:

Over $1 trillion needed for energy transition metals. An investment of over $1 trillion will be needed in key energy transition metals – aluminium, cobalt, copper, nickel and lithium – over the next 15 years just to meet the growing demands of decarbonisation. Wood Mackenzie, in a new report, says the figure is double what was invested over the last 15 years.

On October 23 Reuters reported:

Biden campaign tells miners it supports domestic production of EV metals. Joe Biden’s campaign has privately told U.S. miners it would support boosting domestic production of metals used to make electric vehicles, solar panels and other products crucial to his climate plan, according to three sources familiar with the matter, in a boon for the mining industry.

Albemarle (NYSE:ALB)

No lithium related news for the month.

Sociedad Quimica y Minera S.A. (NYSE:SQM)

On October 8 Nasdaq reported:

Chile lithium miner SQM says to slash water, brine use at Atacama. The announcement comes two months after SQM lost a high profile legal battle that forced it to begin again on a plan to make amends for over-pumping brine from the environmentally sensitive Atacama..... The company said in a statement announcing its "Sustainable Development Plan" that it would voluntarily reduce its use of brine by 20% from November this year, with a goal of slashing it by 50% by 2030. "We do not believe that this brine extraction reduction will have an impact on our near- or long-term lithium production," the company said in the statement.

On October 8, SQM announced: "SQM announces sustainable development plan."

Investors can read the company's latest presentation here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772], Mineral Resources [ASX:MIN], International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

On October 16, Mineral resources announced: "Sustainability report."

On October 15 S&P Global reported:

China's Ganfeng Lithium expects up to 5x YOY rise in Q3'20 earnings. Ganfeng Lithium Co. Ltd. expects its net profit attributable to shareholders for the third quarter to increase 419.9% to 524.7% year over year to between 173.5 million Chinese yuan and 208.5 million yuan.....For the first nine months of this year, Ganfeng expected its earnings to be 330 million to 365 million yuan, a yearly increase of 0.3% to 10.9%. The company said profit growth was affected by lower prices for lithium products during the period, offset by increased sales in its battery business. Ganfeng attributed the earnings increase to a rise in the stock price of 6.85%-owned Pilbara Minerals Ltd.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

On September 29, 4-traders reported:

Tianqi Lithium warns of $1.9 billion default as loan date looms. China's Tianqi Lithium Corp said on Tuesday it may not be able to make a $1.88 billion repayment due in November on a loan taken out to buy a stake in Sociedad Minera y Quimica de Chile [SQQ] in 2018.

Livent Corp. (LTHM)[GR:8LV] - Spun out from FMC Corp. (NYSE:FMC)

No significant news for the month.

Orocobre [ASX:ORE] [TSX:ORL] (OTCPK:OROCF)

No significant news for the month.

Upcoming catalysts include:

You can read the latest investor presentation here.

Galaxy Resources [ASX:GXY] (OTCPK:GALXF)

On October 14, Galaxy Resources announced:

Quarterly conference call & preliminary results......At Mt Cattlin, Galaxy shipped 16,753 dry metric tonnes (“dmt”) of lithium concentrate during the quarter and 15,700 dmt at the beginning of October. Quarterly production of 30,067 dmt was achieved at a grade of 5.92% Li2O and recovery of 57%, in line with full year guidance.

Upcoming catalysts include:

2020 - Construction progress at SDV.

2022 - SDV Stage 1 production commencement target.

Investors can read my recent article "Galaxy Resources Plan To Be A 100,000tpa Lithium Producer By 2025", and my CEO interview here, and the latest company presentation here.

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On October 12, Pilbara Minerals announced: "Pilgangoora operational update. Sustained higher recoveries, stronger production and sales during September 2020 quarter sees unit costs continue to trend down." Highlights include:

Upcoming catalysts:

2021/22 - Stage 2 commissioning timing to depend on market demand.

Investors can read my article "An Update On Pilbara Minerals", and an interview here.

Altura Mining [ASX:AJM] (OTC:ALTAF)

No news for the month.

Investors can read a company presentation here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

No significant news for the month.

Upcoming catalysts:

2020/21 - Progress on lithium projects in Zeitz, Germany and in Zanesville, Ohio, both in the planning stage.

?2021--> - Stage 2 production at Mibra Lithium-Tantalum mine (additional 90ktpa) planned.

Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

On October 9, Neometals announced:

Legal proceedings relating to Mt Marion. On 8 October 2020, project development company, Neometals Ltd, was served with a writ of summons in respect of proceedings commenced against it in the Supreme Court of Western Australia. The plaintiffs, Mr Murray Ward and his associated company, Roseland Capital Pty Ltd, (“Plaintiffs”) seek damages from Neometals for alleged breaches of contract, breaches of the Australian Consumer Law, and tortious conspiracy. Neometals emphatically denies the Plaintiffs’ claims and intends to vigorously defend the proceedings.

Lithium Americas [TSX:LAC] (LAC)

On October 20, Lithium Americas announced:

Lithium Americas provides corporate update and establishes US$100m ATM program.....the Company has established an at-the-market equity program (the “ATM Program”) that allows the Company to issue up to US$100 million (or its Canadian dollar equivalent) of common shares (the “Common Shares”) from treasury to the public from time to time, at the Company’s discretion. “With over 60% of the capital costs spent and enhanced COVID-19 health and safety protocols in place, we remain fully-funded to advance Caucharí-Olaroz to production,” said Jon Evans, President and CEO. “In Nevada, the permitting process continues to progress as planned with the public comment period complete on the Draft EIS and local support with the recently approved tax abatements from the Governor’s Office of Economic Development. Finally, the Company has decided to implement an ATM Program to strengthen our position as we advance discussions with potential partners and customers at Thacker Pass.”

Upcoming catalysts:

NB: LAC owns 49% of the Cauchari-Olaroz project and partners with Ganfeng Lithium (51%).

Investors can read my article "An Update On Lithium Americas."

Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) - Price = US$42.19.

The LIT fund was up strongly again in October. The current PE is 41.8. My updated model forecast is for lithium demand to increase 3.6 fold between 2020 and end 2025 to ~1.1m tpa, and 9.6x this decade to reach ~3.7m tpa by 2030.

Source: Seeking Alpha

Note: Amplify Advanced Battery Metals and Materials ETF (BATT) is a broad based EV metals fund worth considering.

October saw lithium prices flat.

Highlights for the month were:

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest articles:

Disclosure: I am/we are long Global X Lithium ETF (LIT), NYSE:ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], SQM (NYSE:SQM), ASX:ORE, ASX:GXY, ASX:PLS, ASX:AJM, AMS:AMG, TSX:LAC, TSXV:NLC, ASX:AVZ, ASX:CXO, ASX:NMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.